Proper financial planning is essential to achieving success in today’s volatile economic scenario. Modern applications make managing daily transactions or ensuring security for an extended period easy. Integrating all the advanced money management tools, including car insurance, mobile payment services, and others, forms a significant foundation for effortlessly managing your finances.

Why Car Insurance in Financial Planning is Important:

Car insurance is far more than just a legal requirement; it is rather a fundamental element of sound finance planning. Accidents, theft, or natural disasters can cause massive financial damage. In the event of an unanticipated repair bill, having the right policy for your car insurance keeps your financial objectives on track. The right selection of comprehensive cover according to your needs protects your car as well as your money.

Additionally, many insurance providers now offer flexible payment plans, often integrated with mobile payment platforms. These options allow you to pay premiums conveniently, reducing missed payments and ensuring continuous coverage.

Mobile Payments:

These services will change the way we handle our daily finances on the go. Whether for utility bills or insurance payments, these platforms provide all the speed, security, and convenience you need in handling your day-to-day finances. They help plan finances by swiftly processing transactions with traceability.

For instance, paying for the car insurance premium via the mobile app saves considerable time and also enables transparent monitoring of your payment history. Most platforms include cashback or discount offerings, which further optimize your expenses.

Role Of Money Management Apps:

Money management apps are powerful tools that give you real-time insights into your financial health. They help you budget, monitor spending, and plan for future expenses. Integrating these apps into your financial planning process ensures you remain aware of your income, expenses, and savings goals.

Most of these apps also categorize spending to point out where most money goes, be it in car insurance, groceries, or entertainment. From the analysis of such patterns, one can decide where they need to cut back and where they can invest their money. Some of them provide personal recommendations based on one’s behavior with money and assist users in reaching goals, such as saving for emergencies or planning for retirement.

Unified Financial Strategy:

In order to achieve financial stability, including car insurance, mobile payment, and money management together in a comprehensive plan is necessary:

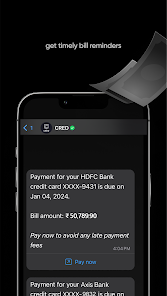

- Priorities: Ensure that your fundamental expenses, such as auto insurance, are paid continuously. Use the reminder features available with mobile payments to keep from losing coverage.

- Track and Optimize: Monitor all payments, including insurance, on a money manager app and set a budget for this recurring expense.

- Automate Payments: Automate car insurance and other essential payments through mobile platforms. Automation neglects the risk of missed deadlines and ensures consistency in your financial plan.

- Analyze and Adjust: Review your spending data from money management apps regularly. Based on changing needs and financial goals, adjust your budget and savings plan.

Conclusion:

Smart financial planning encompasses more than just saving money. It requires a strategic integration of essential services with modern tools. The presence of car insurance prevents an untimely financial shock; mobile payments streamline all transactions, and the use of money management apps ensures staying on track with financial goals.

With all these things together, you can easily construct a strong financial strategy, ensuring stability and growth amid changing times in finance. Start embracing these tools and take control of your future finances today.