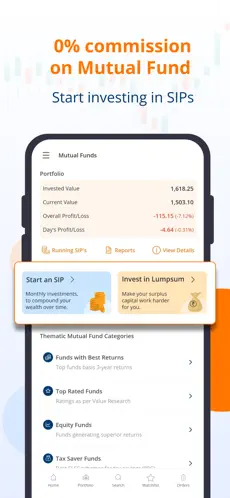

Many people believe that mutual funds in their trading account are an important investment option for long-term wealth accumulation. However, simply investing in mutual funds is not sufficient. Evaluating and tracking their success over the investment period is also critical.

Now that you know how crucial it is to track a fund’s performance, you may be wondering how to quantify it. Let’s investigate this further. There are various mutual funds tracker tools that can be used. This blog will cover how to track mutual performance and other crucial features.

Tracking and analyzing the mutual fund performance

Performance vs. Index

The Securities Exchange Board of India (SEBI) requires funds to declare their performance and returns against benchmark indexes across market cycles. These results are evaluated for the Total Returns Index (TRI), which represents the fund’s dividend and capital appreciation returns.

The benchmark index’s performance reflects broader market circumstances. When a person evaluates a fund’s performance in relation to its underlying index, it allows them to make more informed financial decisions.

Risk-adjusted returns

Every mutual fund is exposed to market risk. However, the fund manager devises numerous ways to enable the scheme to create returns while mitigating projected risks. These returns are referred to as risk-adjusted returns. People can use it to evaluate the efficacy of the fund’s returns across categories or even within a specific category.

Tenure of the Fund Manager

When someone invests in a mutual fund, they are indirectly placing their trust in the fund manager. As a result, it is critical to analyze the fund manager’s experience and prior success, as well as how long they have been administering the program.

Comparison of the Fund.

While measuring a fund’s performance is important, it cannot be measured in isolation. This is why it is advisable to create a short list of similar funds and continually monitor their performance. This lets the investor understand how the fund compares against its competitors. Know if there are nifty 50 stocks in it.

Fund Fact Sheet

A fund fact sheet contains basic information on a mutual fund, including portfolio allocation, fund management data, and historical performance. Assessing a fund fact sheet allows investors to keep track of several aspects of the mutual fund, such as its objectives, associated risks, returns, and portfolio diversification. Know if it mentions option trading.

Portfolio Composition

Tracking the composition of a fund’s portfolio might help you understand how well it will perform. Ensure that the portfolio’s underlying securities are high-quality assets that can withstand short-term market volatility while producing attractive returns. In addition, consider whether the fund’s assets can withstand all market cycles and are appropriate for your risk profile and investing strategy. If you want to buy stocks, then the mutual fund portfolio composition consists of different shares based on market statistics.

Historical Returns

The historical returns of a mutual fund reflect its previous performance. Financial gurus recommend tracking this data to determine the likelihood of future returns. This information assists a person in understanding the factors that influence volatility in a fund’s performance.

Potential investors should remember that analyzing a single year’s data is insufficient because it does not effectively capture market swings. To watch and analyze a fund’s movement trend, one must accumulate its annual returns across multiple years.